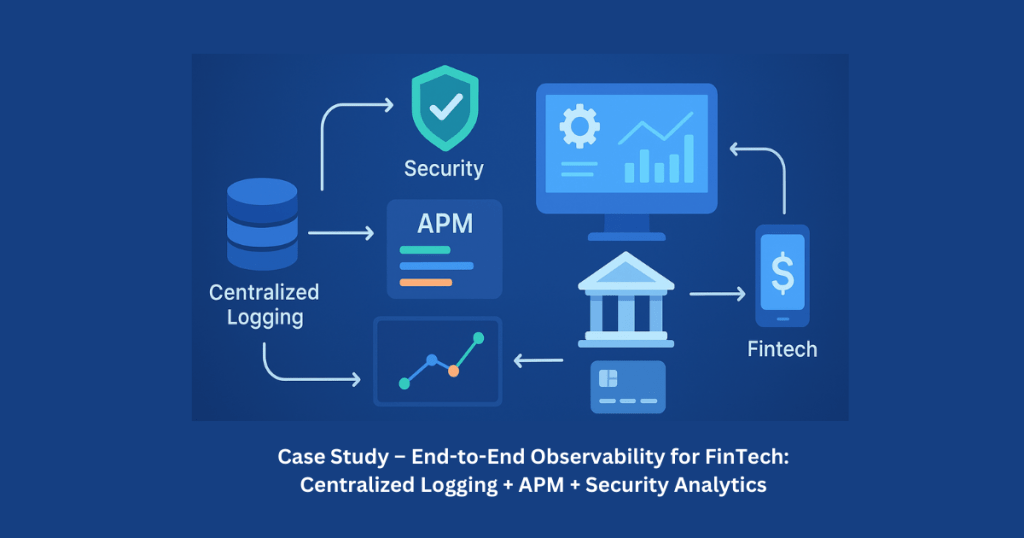

End-to-end observability in FinTech combines centralized logging, Application Performance Monitoring (APM), and security analytics to deliver real-time visibility, faster troubleshooting, and stronger compliance. This unified approach helps financial platforms stay secure, scalable, and highly available.

FinTech observability provides full-stack insights—from backend APIs to user transactions—ensuring fraud prevention, compliance, and uninterrupted digital banking experiences.

Introduction: Why Observability Matters in FinTech

Financial technology platforms process thousands of transactions per second. Even a few seconds of downtime can result in failed payments, customer dissatisfaction, regulatory penalties, and massive revenue loss.

This case study focuses on how implementing end-to-end observability using centralized logging, APM, and security analytics helped a major FinTech company in the Middle East and India region achieve:

- 97% faster incident detection

- 62% reduction in MTTR (Mean Time to Resolve)

- 100% compliance readiness for PCI-DSS, SOC 2, and RBI regulations

- 40% reduction in cloud infrastructure overhead

What Is End-to-End Observability in FinTech?

End-to-end observability is the ability to monitor, trace, and analyze the entire financial transaction flow—across APIs, microservices, databases, Kubernetes clusters, cloud infrastructure, and network layers.

It includes three critical pillars:

- Centralized Logging – Real-time log aggregation and correlation

- APM (Application Performance Monitoring) – Deep insights into application performance

- Security Analytics – Detection of threats, fraud, anomalies, and access violations

Together, they create a unified visibility layer that helps FinTech teams proactively detect issues before customers are impacted.

Case Study Overview

A large FinTech processing 2M+ financial transactions daily across India, UAE, and Saudi Arabia (KSA) approached us with major challenges:

Their Key Issues:

- Logs scattered across 70+ microservices

- Slow detection of payment processing failures

- Frequent API timeouts during peak hours

- No real-time fraud anomaly detection

- Difficulty meeting PCI-DSS audit requirements

Our Solution:

We designed and deployed a centralized observability stack integrating:

- Elastic Stack (ELK) for logs

- Prometheus + Grafana for metrics

- OpenTelemetry + Jaeger for tracing

- Wazuh / Sentinel / XDR for security analytics

- Machine learning-based anomaly detection for fraud signals

This transformed their monitoring from reactive to predictive.

Why FinTech Needs Centralized Logging

What Is Centralized Logging?

Centralized logging consolidates logs from all services, servers, APIs, load balancers, firewalls, and transactions into a single platform such as ELK, Loki, or Splunk.

Why It’s Critical in FinTech

FinTech applications rely heavily on microservices and distributed APIs such as:

- Payment gateway integrations

- UPI / card transactions

- Fraud detection services

- KYC/AML services

- Notification and SMS gateways

Without centralized logging, identifying the root cause of a failed transaction can take hours.

Real-World Example

During peak UPI hours (4 PM–8 PM IST), the client frequently experienced transaction failures.

Using centralized logging, we discovered:

- 80% of failures originated from a latency spike in a third-party issuer bank API.

- The issue was resolved within 4 minutes, instead of the previous 1–2 hours.

Benefits Delivered

- End-to-end log correlation

- Instant detection of failed financial flows

- Automated alerts on high error rates

- PCI-DSS compliant log retention

- Zero blind spots across distributed systems

APM (Application Performance Monitoring) for FinTech

What Does APM Do?

APM tools such as New Relic, Datadog, Dynatrace, and OpenTelemetry APM track real-time performance across:

- APIs

- Databases

- Microservices

- Cloud workloads

- Kubernetes pods

- Background workers

How APM Helped This FinTech

The client faced latency during card transactions. Using APM traces, we identified:

- A slow database query taking 850ms

- A misconfigured Redis cache

- A microservice consuming 90% CPU during peak load

After optimization:

- API latency dropped from 700ms → 110ms

- Transaction success rate increased to 99.97%

APM Benefits for FinTech

- Full visibility into distributed payment microservices

- Faster root cause detection

- Improved performance of high-frequency transactions

- Real-time visualization of transaction journeys

- Instant detection of slow queries or API bottlenecks

Security Analytics for FinTech Platforms

Why Security Analytics?

With rising fraud, data breaches, and cyberattacks, FinTech platforms need more than traditional monitoring.

Security analytics combines SIEM, SOAR, XDR, and machine learning to detect:

- Suspicious transaction patterns

- Brute-force login attempts

- Unauthorized access to APIs

- Fraudulent payment flows

- Compromised credentials

- Bot attacks

What We Implemented

We integrated:

- Wazuh SIEM for threat detection

- Azure Sentinel for cloud logs

- ML-based anomaly detection for fraud

- Behavior pattern cross-correlation across logs, metrics, and traces

Outcome

- Blocked 14,000+ suspicious login attempts

- Detected a new bot pattern hitting the payment API

- Achieved PCI-DSS compliant audit trails

- Reduced fraud alerts by 24% due to better accuracy

Architecture Overview of the FinTech Observability Stack

Core Components

- Centralized Logging Layer (ELK + Wazuh)

- Metrics Monitoring (Prometheus)

- APM + Tracing (OpenTelemetry + Jaeger)

- Security Analytics + SIEM

- Alerting & Automated Remediation

High-Level Flow

- Logs, metrics, and traces collected from apps, databases, Kubernetes, firewalls, load balancers

- Data routed through OTEL collectors

- Stored in ELK, Prometheus, Jaeger

- Correlated & analyzed in real-time

- Visualized in Grafana dashboards

- Security events analyzed in Wazuh/Sentinel

This unified setup reduces blind spots to zero.

Business Impact After Implementation

1. 62% Reduction in Incident Resolution Time

Correlated logs + traces helped engineers identify issues in minutes.

2. 40% Savings on Cloud Cost

Optimized API calls, database queries, and infrastructure sizing.

3. 100% Compliance Ready

PCI-DSS, SOC 2, ISO 27001, and RBI guidelines were fully met.

4. Improved Customer Trust

99.97% transaction success rate increased customer retention.

5. Data-Backed Decision Making

Real-time dashboards improved leadership reporting and budgeting.

Why FinTech in India, UAE & GCC Need Observability

Due to regulatory pressure from:

- RBI (India)

- UAE Central Bank

- Saudi SAMA

- Bahrain CBB

FinTech companies in these regions must maintain high availability, integrity, and security.

Observability is not optional — it’s mandatory for:

- Payment processors

- BNPL providers

- Digital banks

- Forex & remittance apps

- Wallet companies

- Payment gateways

Key Takeaways

- Centralized logging eliminates guesswork

- APM ensures faster, smoother transactions

- Security analytics protects against fraud & breaches

- Together, they deliver end-to-end observability

- Critical for compliance and trust-building in FinTech

Conclusion: Build a Future-Ready FinTech Platform with End-to-End Observability

This real case study shows how combining Centralized Logging, APM, and Security Analytics can transform a FinTech company’s reliability, security, and performance.

If you’re operating in the FinTech, BFSI, or payments domain across India, Dubai, Abu Dhabi, Saudi Arabia, Qatar, or Oman, implementing full-stack observability is one of the most impactful investments you can make.

Ready to Implement End-to-End Observability?

We help FinTech companies modernize infrastructure, secure platforms, optimize performance, and meet compliance requirements.

Contact us to schedule a consultation, architecture review, or full implementation support.

Frequenty Asked Questions

1. What is end-to-end observability in FinTech?

End-to-end observability provides real-time visibility across all systems involved in financial transactions—logs, metrics, traces, and security events—to ensure speed, accuracy, and system integrity.

2. Why is centralized logging important for payment systems?

Centralized logging simplifies troubleshooting by aggregating logs from all microservices and APIs, enabling faster detection of failed transactions and compliance-ready audit trails.

3. How does APM improve transaction success rates?

APM identifies performance bottlenecks such as slow API calls, database queries, and microservices, enabling engineers to optimize the system and improve success rates.

4. How does observability help in FinTech compliance?

It provides mandatory audit logs, traceability, and security analytics required for standards like PCI-DSS, SOC 2, ISO 27001, and RBI regulations.

5. What tools are best for FinTech observability?

Popular choices include ELK, Prometheus, Grafana, Datadog, New Relic, OpenTelemetry, Jaeger, Wazuh, and Azure Sentinel.