Why Nigerian Fintech Companies Need Robust DevOps to Stay Competitive

The demand for digital financial services is at an all-time high, and Nigeria’s fintech sector has therefore grown significantly over the last years with more and more startups. Such growth comes with a lot of challenges and requires some efficient and scalable infrastructure. That is where DevOps consulting services come into play, serving fintech startups with tools that help them stay competitive. A strong DevOps strategy provides seamless operations, quick deployment, and better security-all important features of this fast-moving industry.

In this blog, we will discuss why Nigerian fintech startups need a robust DevOps framework, how Apache Kafka streamlines operations, and why finding the right partner for fintech startup DevOps is crucial to long-term success.

The Landscape of Fintech in Nigeria

The Nigerian market is fast turning out to be one of the leading markets in the African fintech revolution. The rapid use of smartphones and increased internet access drives growth in digital payments, mobile banking, cryptocurrency trading, and peer-to-peer lending platforms.

In any case, all this rapid growth is equally paralleled by challenges in operational complexity, regulatory compliance, and continuous innovation. In such fiercely competitive landscapes, system downtimes, security vulnerabilities, and slow development cycles are something startups should not afford. This is where DevOps plays its vital role.

Why DevOps Is Essential to Nigerian Fintech Startups

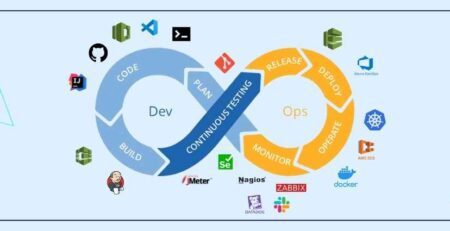

A well-implemented DevOps strategy knits the development and operations by encouraging collaboration between the two departments in question for continuous improvement. This is why DevOps consulting services in Nigeria offer a lot of critical benefits to fintech startups that need to release features quickly.

The first is faster time to market.

The fintech market is fast-moving, and the ability of startups to innovate quickly determines their chances of survival. DevOps practices, like continuous integration and continuous delivery, automate the software delivery pipeline to release in quicker cycles, thus allowing startups to introduce new features and services more rapidly.

A DevOps fintech partner will make these processes smooth, with no delays in testing, integrating, and deploying the new code. Agility is critical to competitive advantage and to be able to meet customers whose needs keep on changing.

Scalability

As the fintech startups scale up, so does their systems to meet the increasing demands. Therefore, it is really time-consuming and error-prone to scale up infrastructures manually. DevOps practices, like infrastructure as code, enable a startup to scale up automatically per demand. This ensures high availability at any given moment in time, such as holidays or promotions.

In such a case, the collaboration of any serious startup with a professional DevOps consulting service in Nigeria should deliver scalable solutions that will help grow together with their business and not at the cost of performance. Improved Security

The issue of security is probably one of the most feared when dealing with sensitive financial information by a Fintech startup. A DevOps approach incorporates security at every stage of development and deployment, hence generally known as DevSecOps. Embedding the best practices of security, including automated scanning for vulnerabilities and real-time monitoring, will reduce the risk of potential cyberattacks and data breaches for a Fintech startup.

In this respect, security with a reliable DevOps partner in the case of a fintech startup company will be included in each stage of the software development life cycle rather than being an afterthought.

Operational Efficiency

The inefficiency in operations can drive fins towards slowing down fintech startups and can result in wastage of time and resources. DevOps aims at nurturing automation in all repetitive tasks such as testing of software, infrastructure provisioning, etc., and monitoring. Automation of tasks frees the teams to work on strategic tasks and hence enhances the overall productivity of teams.

DevOps consulting services in Nigeria can ensure fintech startups create optimized operations that reduce manual workload by enhancing team efficiency.

Role of Apache Kafka in Fintech DevOps

However, beyond all traditional DevOps practices, a fintech startup deploys advanced technologies like Kafka in order to deal with real-time data processing. Apache Kafka is an open-source distributed streaming platform which could provide the ability for real-time processing of large volumes of data hence vital for those fintech applications that are dealing with high transaction rates.

Real-time Data Processing

Fintech deals in real-time transaction processing. This means, with Apache Kafka, the startups can process transactions in real time, analyze user behavior, and detect fraudulent activities on the go. This ensures smoothness at the user side and all the transactions are secured.

Scalability

Apache Kafka has a highly scalable architecture; therefore, it is an excellent fit for fast-scaling FinTech startups. Due to the fact that the number of transactions keeps growing, Kafka can scale horizontally by adding nodes to its cluster, making sure that the platform resists increased loads without performance bottlenecks.

Integration with DevOps Pipelines

Apache Kafka is fully integrated with a DevOps pipeline: a continuous streaming and processing of data. Integrating Kafka into one’s DevOps strategy will make fintech startups assure a smooth flow of data interservice, both in reliability and speed.

Fraud Detection and Risk Management

Fraud detection and risk management become highly critical for any financial technology startup. Transactions can be monitored in real time using Apache Kafka, which detects unusual patterns indicative of fraudulent activities. Thus, Kafka allows fintech platforms to take immediate action if there is a perceived threat, hence ensuring minimal risk and improved security.

How 24x7ServerManagement Can Help

Partnering with a reliable DevOps partner for a fintech startup, such as 24x7ServerManagement, is a game-changer. Here’s why:

Fintech Expertise: 24x7ServerManagement has lots of experience with providing DevOps consulting in Nigeria and hence knows what pain points fintech startups face.

Custom Solution: Every startup is unique. Providing bespoke DevOps solutions that include the creation of Continuous Integration/Continuous Deployment, security integrations, and scalable infrastructure, 24x7ServerManagement can grow a Fintech business.

Apache Kafka: In this context, the Kafka experts at 24x7ServerManagement will be able to help with its integration into your operations and assure real-time processing and high scalability for your Fintech platform.

Continuous Support: DevOps is not a one-time setup; rather, it is an ongoing process. So, 24x7ServerManagement continuously monitors your server and provides essential support to let your platform run smoothly and secure all the time.

Conclusion

Other than a great idea, what startups need to thrive in Nigeria’s very competitive fintech space is solid infrastructure, secure systems, and the ability to scale up quickly. This is where DevOps consulting services are extremely useful in the country.

Ultimately, working with an experienced DevOps partner for fintech startups like 24x7ServerManagement will make a difference by granting the startup agility, security, and scalability to be very effective. With the inclusion of technologies such as Apache Kafka in the DevOps strategy, a fintech platform would process data in real time and hence provide users with a seamless experience in a secure environment.